CFPB to distribute more than $53 million to consumers harmed by BrightSpeed Solutions

July 23, 2024 / Source: CFPB

In July, 122,507 consumers harmed by BrightSpeed Solutions and its founder, Kevin Howard, will begin receiving refund checks in the mail.

The CFPB brought a lawsuit against the privately-owned, third-party payment processor and its founder, Kevin Howard, for knowingly facilitating payments for companies that tricked consumers into expensive and unnecessary antivirus software or services. In many cases, targeted consumers were older adults unaware that the services and software were available for free.

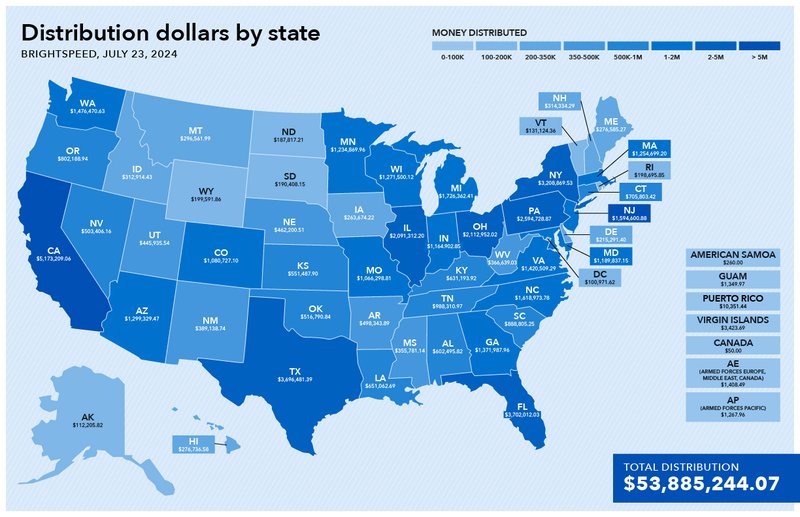

As a result of the lawsuit, the CFPB will distribute $53,885,244 in total payments to consumers through its Civil Penalty Fund. The payments will be mailed on July 23, 2024, through Epiq Systems.

If you have questions about receiving a refund, email [email protected] or call 1 (877) 830-1746. Learn more about the distribution.

Action against BrightSpeed Solutions

Chicago-based BrightSpeed was a privately owned, third-party payment processor founded in 2015 and operated by Howard. BrightSpeed ceased operations in March 2019.

From 2016 to 2018, BrightSpeed and Howard processed remotely-created check payments for more than 100 client companies, totaling more than $70 million. A remotely created check payment is often produced by a payee or its service provider and drawn from a consumer’s bank account and authorized over the telephone or the internet.

The CFPB alleges many of BrightSpeed’s client companies purported to provide antivirus software and technical-support services to consumers, particularly older adults, but they instead scammed consumers into purchasing unnecessary and expensive computer software and services for amounts as high as $2,000. The client companies allegedly sold their products and services through fraudulent telemarketing schemes and received payments through remotely created checks processed by BrightSpeed.