Mortgage financing options in a higher interest rate environment

December 21, 2022 / Source: CFPB

Over the past two years, interest rates have risen from historical lows to as high as 7% for 30-year fixed-rate mortgages. Interest rates have remained elevated at levels that haven’t been seen for nearly 20 years. According to recent CFPB analysis of quarterly HMDA data, these higher rates have already led to increased monthly payments and higher debt-to-income ratios for mortgage borrowers.

In response to the increasing mortgage interest rates, financial service providers are marketing alternative financing options that may offer opportunities for consumers to access lower rates in this relatively high interest rate environment. Providers may also be offering products such as cash out refinances that can be costly to consumers when they replace an existing low interest rate mortgage with one at a higher current rate. If you’re considering one of these mortgage products, you’ll want to look at it closely to understand the risks and whether it meets your needs.

Below we discuss some of the more common product options being offered.

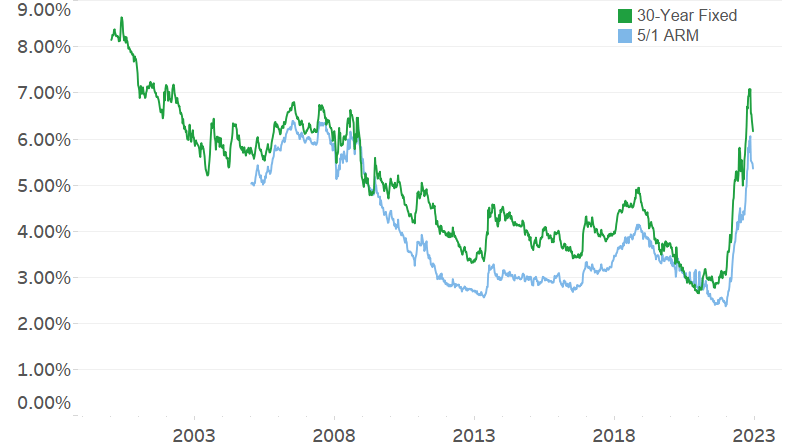

Mortgage Interest Rates, January 2000 to December 2022

Source: Freddie Mac Primary Mortgage Market Survey. Data are available on 5/1 ARMs starting in January 2005.

Alternative Mortgage Products

Adjustable-Rate Mortgages (ARMs). While the overall market for mortgages has declined, ARMs have increased from less than 5% of mortgages in 2019 to around 10%. ARMs typically have a fixed interest rate in the beginning and then adjust annually or every six months. For example, a 5/1 ARM has a fixed interest rate for five years and then adjusts every year for the rest of the loan. As the above chart shows, the initial rate for ARMs is almost always below that of a comparable fixed-rate mortgage, sometimes substantially so.

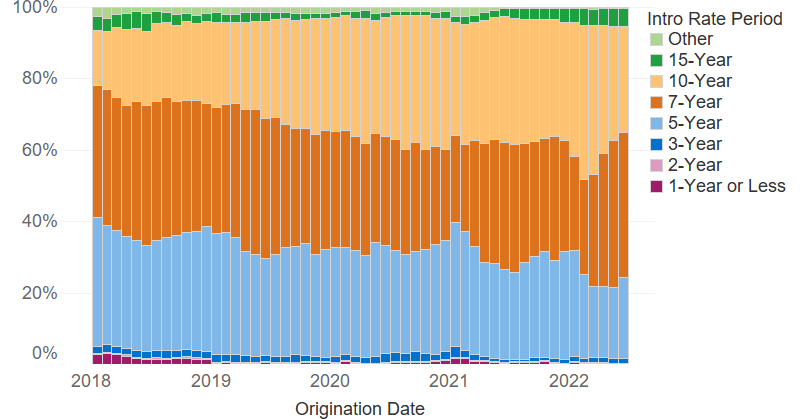

Consumers may be wary of ARMs because of their role in the housing crisis and 2008 recession. However, while these products are not risk-free, ARMs today look very different than those of the earlier era. Before the 2008 recession, many ARMs had fixed-rate periods of three years or less. Today most ARMs have fixed periods of five, seven, or even 10 years.

During the fixed period, the interest rate won’t change even if market rates go up, providing stability for homeowners during this time. And most ARMs today, in accordance with federal law, take into account the maximum payment in the first five years in assessing “ability to repay.” As a result, today’s ARMs are much less volatile than the ARMs made in the years leading up to the Great Recession, and thus much less likely to lead to payment shock.

Thus, ARMs may provide a good option for certain consumers by offering a lower interest rate as compared to a fixed rate mortgage while providing initial rate stability. For consumers planning to sell their home during the fixed period an ARM may work well by providing rate stability during the time the consumer expects to keep the loan. The longer fixed-rate period may also give consumers more time to refinance if rates fall in the future. However, borrowers may find themselves facing higher payments after the fixed-rate period ends.

When deciding if an ARM is right, consumers should consider when the payments would change and their ability to make higher payments in the future, against the benefit of the lower initial cost. For a deeper look into how adjustable rate mortgages work and how to better understand these differences, the CFPB’s Consumer Handbook on Adjustable Rate Mortgages may be helpful.

Initial Interest Rate Period, January 2018 to June 2022

Source: HMDA quarterly data for closed-end (excluding reverse mortgage) site-built single-family first-lien principal-residence home originations.

Temporary Buydowns. As rates have been increasing, some commentators and financial institutions have been encouraging consumers to use temporary buydowns to access lower interest rates. With a temporary buydown, the mortgage payment is lowered for the first year or two in exchange for an up-front fee or a higher interest rate later. This process is called “buying down” an interest rate. Although the initial interest rate and payments are lower, the long-term rate and payments may be higher than a fixed-rate mortgage without the buydown feature.

When considering a temporary buydown, consumers should compare the costs for loans with and without the temporary reduced rate to determine the best product for their needs over time. The annual percentage rate (APR) can help provide information as to which loan is cheaper over the life of the loan.

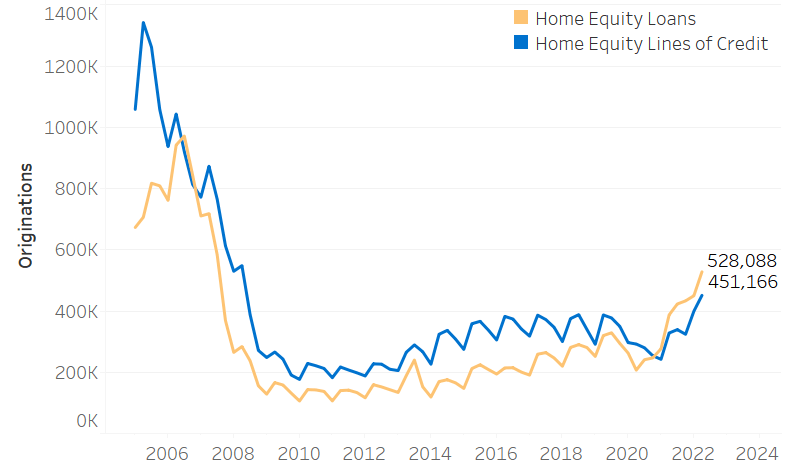

Home Equity Line of Credit (HELOC) or Home Equity Loan. Nearly a million consumers borrowed against their home equity using home equity loans or lines of credit in Q2 2022. This represents a 37% increase from Q2 of the previous year but well below the highs seen in 2005. HELOCs usually come with an adjustable interest rate and allow borrowers to use the funds when needed on a line of credit for a specific time, usually about ten years.

After that, the HELOC enters the repayment phase where the homeowner cannot borrow additional funds and must make minimum payments to pay off the debt. Home equity loans are usually fixed-rate loans for a set amount that is repaid over a specific term.

Home equity lending may be a good option for homeowners seeking to leverage the equity they have in their home without having to replace an existing low interest rate mortgage with a higher interest rate cash-out refinance. With both home equity loans and HELOCs, as well as cash out refinances, there can be the temptation to pay off other debt or use the equity to pay for living expenses. While a home mortgage almost always has a lower interest rate than a credit card, refinancing credit card debt with a home loan can put the home at risk if the borrower is unable to make future payments.

For more information, download the CFPB’s “What you should know about Home Equity Lines of Credit ” information booklet.

Home Equity Loans and Lines of Credit, Q1 2005 to Q2 2022

Source: Credit Forecast

Loan Assumption. Some home purchasers have the ability to take over a low interest rate loan from the home seller as part of the sales transaction. Most loans backed by the Federal Housing Administration (FHA), the U.S. Department of Veterans Affairs (VA), or U.S. Department of Agriculture (USDA) can be “assumed.”

With a loan assumption, the homebuyer takes over the remaining balance of the home seller’s mortgage with the original loan terms. This would allow a purchaser to take over a fixed rate mortgage with a rate far below the current market, providing large savings on interest and the related payment.

Loan assumptions may not always be feasible. A purchaser needs to make up any difference between the sales price and the outstanding balance of the assumed loan. Finding a lender willing to make a second mortgage for the difference may be challenging, particularly given existing limitations in lending programs.

As a result, it may be easier for higher-income and higher-wealth borrowers who can make larger cash down payments to take advantage of the assumability of the existing low-interest mortgage. Nonetheless, home buyers may wish to consider asking the seller about the availability of an outstanding mortgage for assumption in select circumstances.

Alternative Sales Transactions

In addition to traditional home loans, consumers may be offered alternative financing arrangements. These include contract-for-deeds or land contracts, rent-to-own arrangements, and equity-sharing arrangements. These unorthodox financing arrangements often have features that can impact consumers’ finances down the road, such as a balloon payment or a requirement to share future proceeds from the sale of the house.

These products may sound tempting in the current market with higher interest rates. However, many lack the protections of traditional mortgages, including the ability to build and access home equity, foreclosure protections, or even basic disclosures that allow for comparison shopping.

Consumers looking into an alternative financing arrangement should carefully consider the potential financial consequences, today and in the future.