The U.S. Economic Recovery in International Context

June 5, 2023 / Source: Treasury

By: Assistant Secretary for Economic Policy Benjamin Harris and Deputy Assistant Secretary for Macroeconomic Policy Tara Sinclair

OVERVIEW

With the American Rescue Plan’s two-year anniversary now behind us, this blog post revisits the economic impact of pandemic response policies of the Biden Administration. The economic recovery from the pandemic in the United States has been historic relative to prior episodes with employment recovering to pre-crisis levels much faster than after recent recessions. And while a counterfactual recovery is impossible to observe, data suggests that the actions taken by the Biden Administration meaningfully contributed to the pace of recovery and strength of the labor market. One way to put this rebound in context is relative to recoveries in other advanced economies. Acknowledging that other advanced economies faced different economic shocks—notably, our European partners were more adversely affected by Russia’s war against Ukraine—the evidence shows that the U.S. economic recovery has been quite strong.

This blog assesses the U.S. recovery along three key characteristics:

- The size of the U.S economy is now over 5 percent above its 2019 level

- Core inflation in the United States is now lower than in many major advanced economies

- The U.S. labor market recovery has been exceptionally strong

This is not to suggest that the current recovery is without its challenges. Near-term inflation remains a concern, and long-term structural challenges remain. Still, many aspects of the U.S. recovery indicate a stronger recovery in the U.S. relative to other economies.

U.S. ECONOMIC RECOVERY FASTEST AMONG COMPARABLE ADVANCED ECONOMIES

For many advanced economies, real GDP it is at, or above, where it was in the fourth quarter of 2019, prior to the start of the pandemic. However, there is considerable variability across countries. Not all G7 economies have fully recovered to their pre-pandemic size; by contrast, U.S. real GDP is now 5.4 percent above the level at the end of 2019.

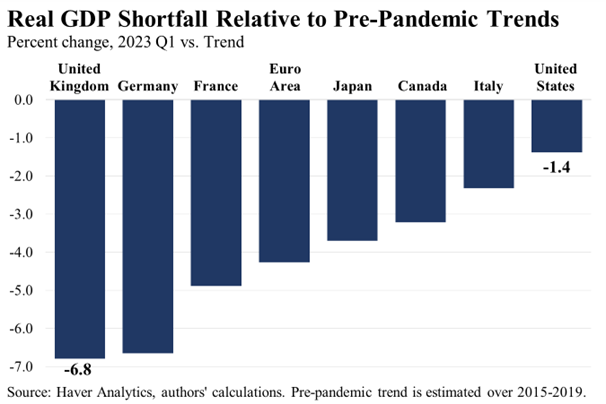

Relative to pre-pandemic trends, economic output continues to fall short. However, the United States has performed better than other G7 economies (and the Euro area) with real GDP just 1.4 percent below trend.

The fast recovery in the United States reflects a more complete recovery in domestic consumption. In fact, U.S. household consumption expenditures returned to their pre-pandemic trend by the second quarter of 2021. However, household consumption remains below pre-pandemic trend in most other advanced economies, as the recovery in final demand remains incomplete.

DESPITE HIGHER GROWTH, U.S. CORE INFLATION IS NOW LOWER THAN IN MANY OTHER MAJOR ADVANCED ECONOMIES

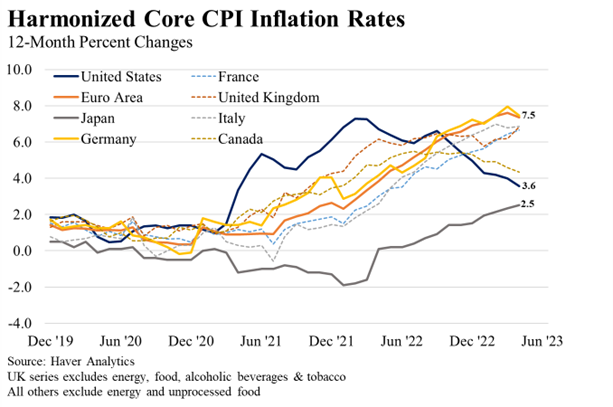

Faster output growth in the United States was initially accompanied by higher inflation, but inflation rates have been rising rapidly around the world. In Europe, inflation rates rose quickly in 2022 due to a combination of high natural gas prices and the restart of the European economy after tight Covid restrictions during the Delta and Omicron waves. Conversely, over the course of 2022, the United States saw substantial improvement in inflation, while European inflation rates continued to rise. Of course, energy prices in Europe have been hit particularly hard by Russia’s unlawful invasion of Ukraine. Excluding energy and food, core inflation rates (on a harmonized basis) are running under 4 percent in the United States, whereas they are nearly 6 percent in the United Kingdom and over 7 percent in the Euro area.[1]

THE U.S. LABOR MARKET RECOVERY HAS BEEN EXCEPTIONALLY STRONG

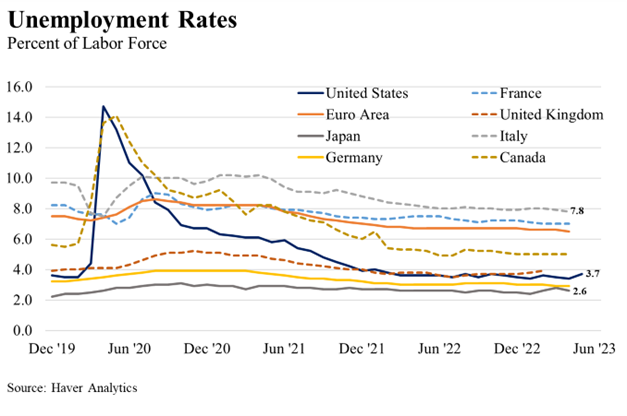

Employment statistics appear to show striking differences across G7 economies during the Covid-era. For instance, the United States and Canada had their unemployment rates skyrocket in April and May 2020—up 11.1 and 8.5 percentage points from December 2019, respectively—while many European unemployment rates stayed relatively flat. In fact, in France and Italy unemployment rates fell markedly in the initial months of the pandemic.

Despite initial impressions, this did not reflect significant divergence in labor activity. Rather, these trends reflect differences across national labor institutions. Each government used their existing institutions to support workers and businesses through the initial Covid shutdown. In the United States and Canada, unemployment insurance was most suited to rapid, large-scale support. Many European economies also leveraged their social safety nets, often in a way that led to continued employment in official statistics—analogous to the United States’ little-used Workshare program. The broader and stronger fiscal response resulted in generally higher U.S. government deficits during the pandemic. However, deficits contracted quickly as pandemic support largely ended by the third quarter of 2021. At the end of 2022 the United States had a similar budget deficit as a share of GDP as peer countries.

The official statistics of most other G7 economies do not show a sharp rise in the unemployment rate in the spring of 2020, nor a corresponding robust recovery. Again, this is partially a result of differing labor market institutions and pandemic-era policies, rather than a reflection of underlying differences in labor activity. In January the unemployment rate in the United States reached a more than 50-year low. Germany has seen similar lows, while Canada and the United Kingdom are also near their lows.

The similar recovery in the labor market, despite disparate recoveries in output, has implications for labor productivity. Labor productivity growth in the United States has outpaced that in Europe and Japan. Here, labor market policies may be playing a role. The U.S. system is based primarily on unemployment insurance, which may have allowed for greater labor reallocation relative to systems that preserved employer attachment. In general, U.S. employment has reallocated from lower wage industries to high-wage and higher productivity industries. U.S. employment has also shifted to industries with higher average hours worked, implying a stronger recovery in hours relative to employment. This reallocation of labor may drive further gains in labor productivity going forward.

[1] Harmonized inflation ensures comparability between U.S. and European inflation measurement; the U.S. harmonized inflation rate is produced by the Bureau of Labor Statistics. Harmonized inflation not available for the United Kingdom, Canada, and Japan; core CPI inflation shown for these countries.